For more than a decade, EDH has been at the forefront of empirical research in documenting the development experience associated with re-introduction of streetcar systems into a re-urbanized America. In this post, I summarize what has been learned from the longest-running experience to date with a new, fully modern streetcar system - in Portland, Oregon.

The Portland Streetcar Experience

In 2001, Portland opened a new Central City streetcar line extending through the city’s Downtown area (west of the Willamette River). In addition to serving the Downtown and adjoining Pearl District, subsequent extensions have since been made to Portland’s established Northwest District and to the rapidly redevelopment South Waterfront District. The initial Central City line represented the start of the first modern streetcar system built in America.

The Big Burst

In-depth research of the post-streetcar investment and development experience in Portland was conducted in 2005 by E. D. Hovee & Company, LLC. This retrospective look documented the role streetcar investment has played as a catalyst both to re-orient where development occurs and to facilitate a more urban (or higher density) scale of development

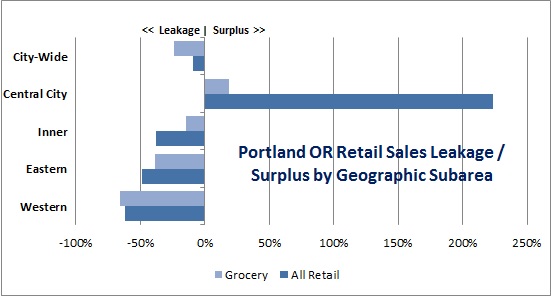

Pace & Location of New Development. As depicted by the following graph, after a streetcar funding plan was put in place in 1997 (with construction subsequently starting in 1999 and opening in 2001), development in proximity to the alignment took off. From 1997-2004, properties situated within one block of streetcar captured 55% of all new development within neighborhoods through which the streetcar line passed.

Pre-streetcar (or prior to the 1997 funding commitment), these same blocks represented less than 20% of the total building inventory in the Downtown/Pearl District area. Taken together, properties situated within three blocks of the Portland Streetcar went from 47% of area development pre-1997 to 75% of post-1997 development with streetcar.

Intensity of Development. There also has been a relationship demonstrated between the density of post-streetcar development and proximity to the streetcar line – with much greater levels of density in development taking place near the line. As shown by this next graph (below), within one block of the streetcar line, post-streetcar development has achieved nearly 90% of the floor area ratios (FARs) the zoning allowed.

The ratio of development actually experienced in relation to zoned development capacity steadily declines as distance from streetcar increased – to only 43% of allowed FAR for new development situated more than three blocks from streetcar.

Added Notes. Along with streetcar, key factors affecting the location, pace and scale of recent Central City residential, office, retail and mixed-use projects have included public-private development agreements with major property owners and consolidated land ownerships – both of which accompanied the first wave of development activity along the alignment. Also noted was that sites within one block of streetcar experienced a 5.8% rate of average annual increase to the existing building stock (over an 8-year period) with new construction versus a 1.0% annual rate of increase at a distance of more than three blocks from the streetcar alignment.

Updated Experience

Supplemental analysis indicates that transit oriented development (TOD) related to streetcar in Portland is still continuing at a rapid pace, despite the temporary slowdown of investment realized during the Great Recession. Looking over a more extended 16-year period from 1997-2012, the overall pace of development (on the 1997 base) has continued at about the same rate as early-on.

A greater share of new development has shifted to the 2- and 3-block distance in recent years, though projects within a 1-block (200 foot) distance of streetcar still continue to account for the greatest share of development. Development densities also have continued to increase in relation to zoned maximums, with particular gains noted at the 2-3 block distance.

Overall, from 1997-2012, assessed property values within 1-3 blocks of Portland’s streetcar alignment have increased by 330% as compared with a just over 130% increase in valuation across all properties citywide – reflecting an overall streetcar premium that is more than 2.5 times the citywide valuation growth rate. Building improvement valuation gains have been greatest for properties within 1 block of the alignment, with strong land valuation appreciation noted across the full 1-3 block impact area benefited by streetcar.

From TOD to Development Oriented Transit

The Portland experience suggests the value of turning the traditional TOD paradigm on its head. While it is increasingly clear that residential, employment and mixed use development will respond to transit investment, it has become even more apparent that the best transit investments are intentionally located, designed and operated to better facilitate property owner and development capacities. In effect, this public-private feedback loop shifts the emphasis from transit as the sole driver to a development-first paradigm - as the most opportune mechanism to maximize public and private return on investment (ROI).